Unlock

the Heartland

Partnering with investors to create sustainable housing solutions where America lives and works.

About Us

Caisson Capital Partners is a Northwest Arkansas-based real estate investment and development firm focused on attainable housing in heartland markets. We combine deep local market expertise with global institutional experience to deliver exceptional returns for investors while improving communities.

Our Approach

We invest in attainable multifamily housing in the heartland. We seek out under-managed assets near strong workforce employment drivers that can become great attainable communities through physical enhancements and better management.

Recent Investments

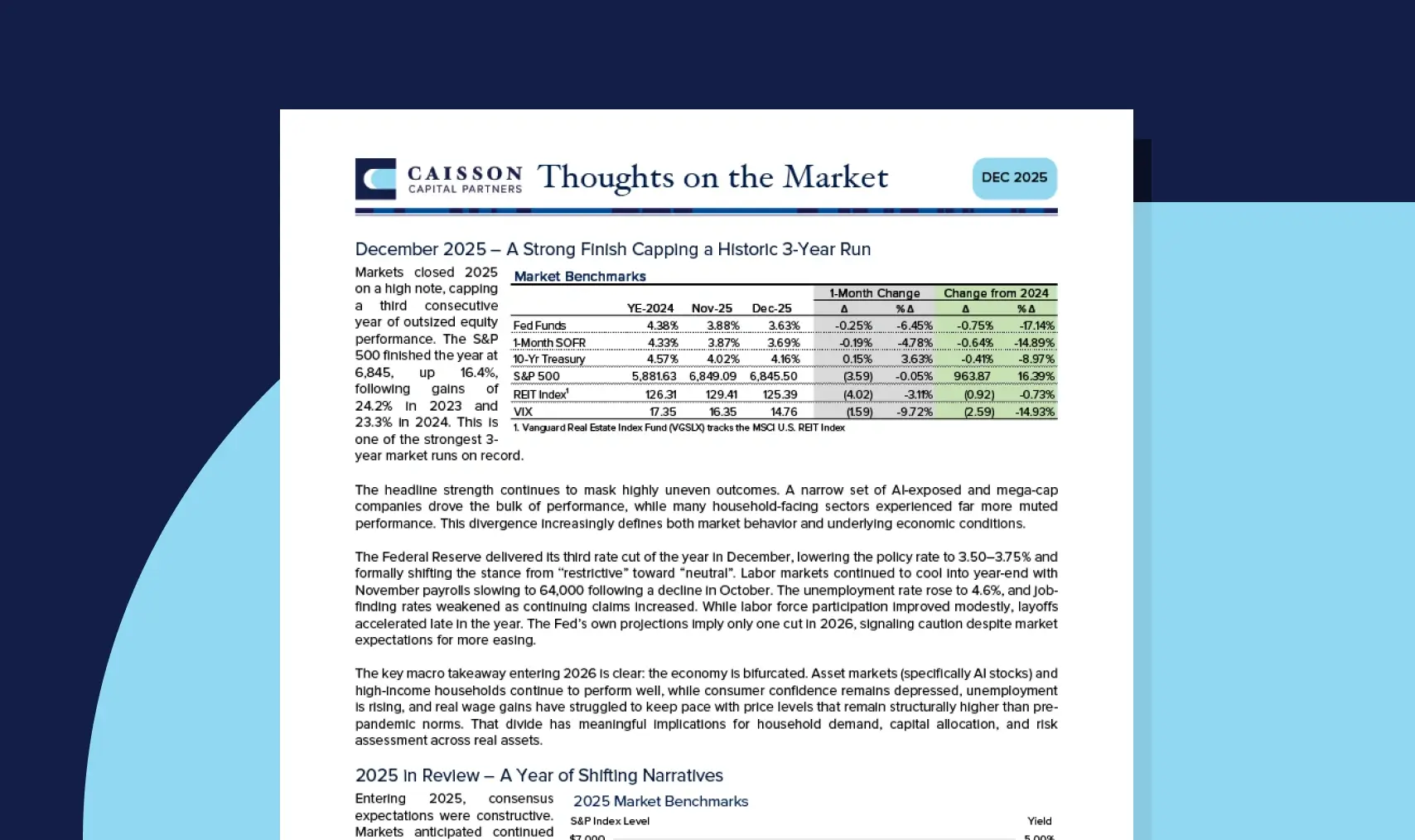

December 2025

Market Report

We provide our latest insights into the ever-evolving investment landscape, focusing on multifamily investments.

Download Report